A common scenario in today’s corporate landscape is a divide amongst a company’s leadership on how much to invest in innovation. While your Strategy and IT teams are advocating to substantially increase the investment in technology innovation, your CFO insists that aggressive cost-cutting is the lowest risk path to prepare for a future you don’t fully control.

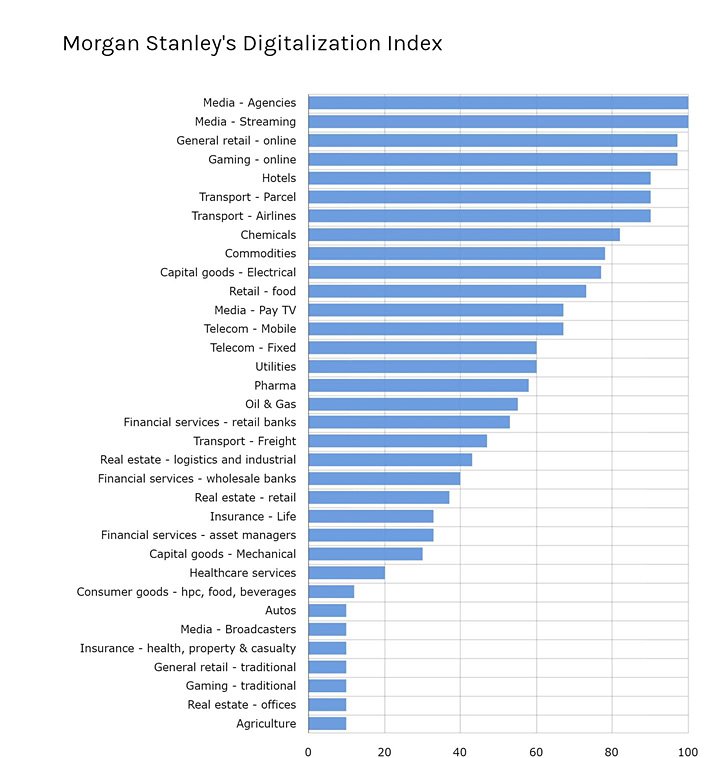

A study by Morgan Stanley (below) shows that many industries are still to reap the benefits or suffer the impact of digitalization. Even in apparent “digitally matured” industries such as retail, media and finance, the digitalization journey is only starting, there is still huge improvement potential locked in companies by long-standing business practices, regulatory constraints, and plain inertia. Each industry is changing at its own speed and managing the pace of innovation is essential to protect enterprise value.

With strong leadership, smart investment, and a set of common, clearly defined goals, innovation can have a significant payoff. For instance, in early 2006, Ford Motor Company was facing bankruptcy and thus began a massive overhaul of their company’s structure. This included slashing their IT budget by 30{17199d8aa9806a12d04ee520f5ea2bc09de3155a25f3599635ddf13faf62b30a} and using those resources to invest in innovative digital projects such as Ford SYNC and MyFord Touch. Both projects were enthusiastically welcomed by consumers, and Ford is one of the most successful automakers in the U.S. today, with a market share of around 15{17199d8aa9806a12d04ee520f5ea2bc09de3155a25f3599635ddf13faf62b30a} in 2016.

Similarly, the UK retail chain, Argos, transformed its operations to become a digital-retailer in 2012. Only a year later, argos.co.uk became the second most-visited mobile retail site in the UK, and the company showed that nearly half of Argos’ total sales came from the web.

These stories show just how much investing in innovation can benefit a company. However, it is important to not only look at the substantial potential advantages of innovation – but to also discuss the serious potential risks of not innovating. In this digital age, companies that do not innovate risk being left behind while their customers flock to their digitizing competitors. An example of this fate is Borders, a bookstore chain that failed to adapt to consumers’ shifting preferences for shopping online and as a result, closed all of its stores in 2011.

For a company to successfully innovate in order to compete and succeed in its respective industry, it is vital that the leadership – the CEO, the CFO, the CIO – figure out not only how and where it should innovate, but at what pace to invest. Some of the pivotal questions that should be addressed when beginning to address the topic of innovation include:

- How much should our company invest today in digitalization and innovation?

- Is outspending our competition enough? Should we disrupt our industry before others do it?

- Can our company execute large, costly innovation projects – or will the cost outweigh the results?

- Is it better to reduce costs now and reserve cash to invest later, when technology is less expensive and more effective?

- Where can we afford to reduce costs, and where can we afford to invest?

- What is the real return on innovation/digitalization investment? How do we measure it and how do we separate good from bad investments?

- Should we invest to preserve their Jobs or to deliver shareholders value? Would shareholders be better off with dividends which they can re-invest as they choose, including in risky technology of their liking?

- How do we provide strong leadership and rational decision-making in times of real transformation, hype, and uncertainty?

Ultimately, the success of a company’s innovation project lies in the ability of its management team to answer these questions together, develop a clear strategy, and lead the rest of the company toward implementing that strategy.

There is no “one size fits all” solution – each industry and each individual company will have a different pace that works best for them and fits their specific agenda. Abstracta has years of experience working with clients, large and small, in a variety of industries, and can offer in-depth expertise on how to find the right pace, amount, and place to invest in digitalization for your company. Our strategic methodology for managing growth under high uncertainty has helped our clients to navigate these questions and align their management team toward a common goal to deliver substantial results.